What is Risk Management?

- Definition: The process of identifying, assessing, and controlling risks that may affect the achievement of an organization’s objectives.

- Objective: Minimize potential losses and maximize opportunities.

Types of Risks

- Credit Risk:

- Risk of loss due to a borrower’s inability to repay a loan or meet contractual obligations.

- Mitigation: Credit assessment, collateral, and diversification.

- Market Risk:

- Risk of losses due to changes in market prices such as interest rates, foreign exchange rates, and stock prices.

- Mitigation: Hedging strategies, asset allocation, and diversification.

- Hedging strategies are techniques used to reduce or manage market risk (risk of losses due to changes in market prices like stocks, interest rates, currencies, or commodities). Here are some common strategies:

- Diversification: Spreading investments across different asset classes (stocks, bonds, commodities) or sectors to reduce the impact of a loss in any single investment.

- Example: Investing in both technology and healthcare stocks to balance risks.

- Using Derivatives: Derivatives are contracts that derive their value from an underlying asset (stocks, currency, etc.). Common derivative tools include:

- Futures Contracts:

- Agreement to buy/sell an asset at a fixed price in the future.

- Example: A company hedges against rising oil prices by locking in today’s price using oil futures.

- Options Contracts:

- Gives the buyer the right (but not the obligation) to buy/sell an asset at a specific price.

- Example: Buying a put option protects against falling stock prices.

- Forwards and Swaps:

- Forwards: Customized agreements to buy/sell at a fixed future price.

- Swaps: Exchanging cash flows, like interest rate swaps to switch between fixed and floating rates.

- Futures Contracts:

- Diversification: Spreading investments across different asset classes (stocks, bonds, commodities) or sectors to reduce the impact of a loss in any single investment.

- Hedging strategies are techniques used to reduce or manage market risk (risk of losses due to changes in market prices like stocks, interest rates, currencies, or commodities). Here are some common strategies:

- Operational Risk:

- Risk of loss due to failed internal processes, systems, or external events.

- Mitigation: Strong internal controls, contingency plans, and employee training.

- Liquidity Risk:

- Risk that an organization cannot meet its short-term financial obligations due to the inability to convert assets into cash quickly.

- Mitigation: Maintain adequate cash reserves and liquid assets.

- Interest Rate Risk:

- Risk of loss due to changes in interest rates affecting the value of assets or liabilities.

- Mitigation: Use of derivatives like swaps, futures, and options to hedge interest rate fluctuations.

- Foreign Exchange Risk:

- Risk of losses due to changes in exchange rates.

- Mitigation: Currency hedging strategies and diversification into foreign assets.

- Reputational Risk:

- Risk of damage to a company’s reputation, leading to loss of customers or investors.

- Mitigation: Ethical business practices, clear communication, and effective crisis management.

Risk Management Framework

- Risk Identification:

- Recognizing potential risks that may affect the organization.

- Methods: Risk assessments, audits, and brainstorming.

- Risk Assessment:

- Evaluating the likelihood and impact of identified risks.

- Techniques: Risk matrices, scenario analysis, and qualitative/quantitative assessments.

- Risk Matrices: A risk matrix is a tool that helps visualize and prioritize risks based on two key factors:

- 1. Likelihood (How likely is the risk to occur?)

- 2. Impact (How severe would the risk be if it occurs?)

- Risks are plotted on a grid or matrix, often color-coded:

- Low risk (Green) → Minor impact, low likelihood.

- Medium risk (Yellow) → Moderate impact or likelihood.

- High risk (Red) → High likelihood and severe impact.

- Example: If a cyber-attack has a high chance of happening and can cause major financial damage, it will be marked as a high-risk event.

- Scenario Analysis: This involves assessing how different “what-if scenarios” could affect an organization.

- It considers best-case, worst-case, and most-likely outcomes for specific risks.

- How It Works:

- Identify a specific risk (e.g., economic slowdown).

- Create scenarios (e.g., 10% sales drop, 20% sales drop).

- Analyze the impact of each scenario on operations, revenue, or costs.

- Example: A company might simulate the effects of rising interest rates to understand how it will impact loan repayments.

- Qualitative and Quantitative Risk Assessments

- Qualitative Risk Assessment:

- Focuses on describing and prioritizing risks using non-numerical data.

- Risks are rated using categories like high, medium, or low based on expert judgment, interviews, or risk matrices.

- Example: A project manager might say a delay in project delivery is a “high risk” based on experience.

- Quantitative Risk Assessment:

- Focuses on assigning numerical values to risks to measure their financial or statistical impact.

- Uses tools like probability models, monetary values, or statistical analysis.

- Example: A 20% chance of a system failure that could cause a loss of ₹10 lakh would result in an expected loss of ₹2 lakh (20% of ₹10 lakh).

- Qualitative Risk Assessment:

- Risk Matrices: A risk matrix is a tool that helps visualize and prioritize risks based on two key factors:

- Risk Control:

- Developing strategies to reduce, avoid, transfer, or accept risks.

- Methods: Risk mitigation plans, insurance, and hedging.

- Risk Monitoring:

- Continuously tracking risks and reviewing risk management strategies.

- Tools: Key Risk Indicators (KRIs), risk reports, and audits.

- Key Risk Indicators (KRIs) are metrics or signals used to identify and monitor potential risks in an organization before they escalate into bigger problems. Examples

- Non-Performing Asset (NPA) Ratio: Measures the percentage of bad loans.

- Loan Default Rates: Tracks how many borrowers are defaulting.

- Capital Adequacy Ratio (CAR): Indicates a bank’s financial stability.

- Key Risk Indicators (KRIs) are metrics or signals used to identify and monitor potential risks in an organization before they escalate into bigger problems. Examples

- Risk Reporting:

- Communicating risk-related information to management and stakeholders.

- Methods: Regular risk reports, dashboards, and meetings.

Risk Management Process

- Risk Identification:

- Identify all possible risks that may arise in the organization or project.

- Conducting interviews, brainstorming sessions, and reviewing historical data.

- Risk Assessment:

- Assess the probability and impact of each risk.

- Classify risks as high, medium, or low priority.

- Risk Control:

- Choose an appropriate strategy for managing risks.

- Strategies:

- Avoidance: Change the plan to avoid the risk.

- Mitigation: Reduce the impact or likelihood of the risk.

- Transfer: Shift the risk to a third party (e.g., insurance).

- Acceptance: Accept the risk if it is minor and controllable.

- Risk Monitoring:

- Regularly review the risk management strategies and track risk indicators.

- Update risk management plans as needed.

- Risk Reporting:

- Report risks to key stakeholders and management.

- Maintain transparency in risk management.

Risk Management Tools

- Risk Matrix:

- A visual tool to assess the probability and impact of risks.

- Helps prioritize risks by categorizing them into different severity levels.

- Scenario Analysis:

- Analyzing the effect of different risk scenarios on the organization.

- Helps in preparing for potential worst-case situations.

- Hedging:

- Using financial instruments (e.g., options, futures, swaps) to protect against market, interest rate, or currency risk.

- Hedging is like insurance for your investments. It helps protect you from losses due to changes in prices, currencies, or interest rates by using strategies like derivatives, diversification, and safe-haven assets.

- Example: If you think stock prices may fall, you buy a put option to limit your loss.

- Hedging is like insurance for your investments. It helps protect you from losses due to changes in prices, currencies, or interest rates by using strategies like derivatives, diversification, and safe-haven assets.

- Using financial instruments (e.g., options, futures, swaps) to protect against market, interest rate, or currency risk.

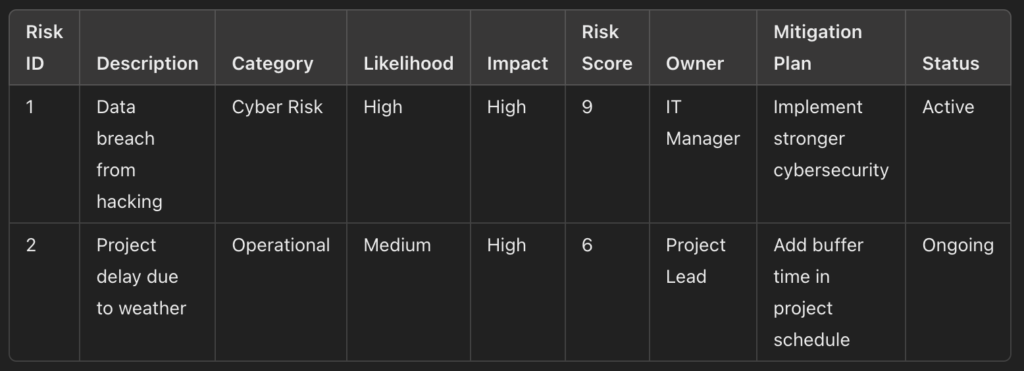

- Risk Register:

- A Risk Register is a tool used in risk management to identify, document, and monitor risks in a project, business, or organization. It helps track risks, assess their impact, and plan responses.

- Components of a Risk Register

- Risk ID: Unique number or name for identifying the risk.

- Risk Description: A brief explanation of the risk event.

- Risk Category: Type of risk (e.g., financial, operational, market, technical).

- Likelihood: Probability of the risk occurring (e.g., high, medium, low).

- Impact: Severity of the risk’s effect on the organization.

- Risk Score: A score combining likelihood and impact to prioritize risks.

- Risk Owner: The person or team responsible for managing the risk.

- Mitigation Plan: Steps or strategies to reduce or eliminate the risk.

- Status: Current status of the risk (e.g., active, resolved, ongoing).

- Example of a Risk Register

Risk Management in Financial Institutions

- Financial institutions face various types of risks, including credit risk, market risk, operational risk, and liquidity risk.

- Basel Accords (Basel I, II, III):

- Global regulatory frameworks to improve risk management in banks.

- Focus on capital adequacy, stress testing, and risk mitigation strategies.

Regulatory and Compliance Aspects

- Basel III:

- Strengthens capital requirements, liquidity standards, and stress testing for banks.

- Aims to enhance the stability of financial institutions.

- Dodd-Frank Act:

- U.S. legislation aimed at reducing financial risk through enhanced regulatory oversight and risk management practices.

- International Financial Reporting Standards (IFRS):

- Set of accounting standards ensuring transparency in financial reporting.

- Impacts risk assessment and financial reporting for organizations.

Risk Mitigation Strategies

- Diversification:

- Spreading investments across different assets or markets to reduce exposure to a single risk.

- Insurance:

- Purchasing insurance policies to transfer the financial impact of certain risks.

- Internal Controls:

- Implementing processes and policies to prevent and detect errors, fraud, or inefficiencies.

- Stress Testing:

- Simulating extreme market conditions to understand the impact on the organization’s financial health.

Key Terms to Remember

- Risk Appetite: The level of risk an organization is willing to accept.

- Risk Tolerance: The acceptable variation in outcomes from risk management strategies.

- Residual Risk: The risk remaining after mitigation measures are applied.

- Risk Exposure: The extent to which an organization is vulnerable to a specific risk.

Risk Management in Treasury

- Market Risk: Treasury operations face credit risk and market risk. Credit risk arises from the counterparty defaulting, while market risk arises from fluctuations in security prices, interest rates, or exchange rates.

- Liquidity Risk: Mismatch between assets and liabilities, e.g., when a bank purchases a government security but borrows at short-term rates.

- Interest Rate Risk: Treasury faces risk due to mismatches in interest rate sensitive assets and liabilities, leading to potential financial instability.

- Internal Controls: Involve setting limits on deal size, open positions, and implementing stop-loss limits to manage trading risks effectively.

Treasury Risk Measures

- Value at Risk (VaR): Measures the potential loss in the value of a portfolio due to market movements within a specified period and confidence level.

- Duration Gap: The difference between the durations of assets and liabilities, useful for measuring interest rate sensitivity.

Role of Treasury in ALM (Asset-Liability Management)

- Liquidity and Interest Rate Sensitivity: Treasury is crucial in managing liquidity risk and interest rate risk through effective asset-liability management. It ensures that the bank can meet short-term liabilities without compromising long-term profitability.

- ALCO (Asset-Liability Committee): Treasury typically works closely with ALCO to manage liquidity and interest rate risks.

Risk Management Framework in Banks

- Internal Controls and Organizational Controls: Ensures proper verification and settlement of transactions, with the middle office overseeing overall risk management.

- Exposure Limits: Establishing ceilings on inter-bank exposure and counterparty risks to limit potential losses.

Risk Management – MCQ

What is the primary objective of risk management?

A. To eliminate all risks

B. To minimize potential losses and maximize opportunities

C. To avoid regulatory compliance

D. To maximize revenue

Answer: B. To minimize potential losses and maximize opportunities

Which of the following is a type of financial risk?

A. Credit Risk

B. Operational Risk

C. Market Risk

D. All of the above

Answer: D

What is ‘credit risk’?

A. Risk of loss due to fluctuations in market prices

B. Risk that a borrower will default on a loan

C. Risk of loss from operational failure

D. Risk of insufficient liquidity

Answer: B. Risk that a borrower will default on a loan

Which of the following is associated with ‘market risk’?

A. Changes in stock prices

B. The failure of internal processes

C. Inability to pay short-term liabilities

D. Poor management decisions

Answer: A. Changes in stock prices

What is the first step in the risk management process?

A. Risk reporting

B. Risk control

C. Risk identification

D. Risk monitoring

Answer: C. Risk identification

Which technique is used to assess the potential impact and likelihood of a risk?

A. Stress Testing

B. Scenario Analysis

C. Risk Matrix

D. Value at Risk (VaR)

Answer: C. Risk Matrix

What is ‘risk control’?

A. Identifying risks in the organization

B. Developing strategies to mitigate identified risks

C. Monitoring ongoing risks

D. Reporting risks to management

Answer: B. Developing strategies to mitigate identified risks

What does ‘operational risk’ refer to?

A. Risk of market price fluctuations

B. Risk due to failures in internal processes or systems

C. Risk of not meeting liquidity requirements

D. Risk from incorrect financial reporting

Answer: B. Risk due to failures in internal processes or systems

Which type of risk arises from the changes in interest rates?

A. Credit Risk

B. Operational Risk

C. Liquidity Risk

D. Interest Rate Risk

Answer: D. Interest Rate Risk

Liquidity risk occurs when an organization:

A. Cannot meet its short-term financial obligations

B. Faces fluctuations in interest rates

C. Has insufficient credit to lend

D. Experiences credit default by customers

Answer: A. Cannot meet its short-term financial obligations

What is ‘Value at Risk’ (VaR)?

A. A measure of potential loss in a portfolio over a set period

B. A measure of operational failures in a company

C. A method of diversifying investments to reduce risks

D. A report on customer creditworthiness

Answer: A. A measure of potential loss in a portfolio over a set period

Which of the following is used to manage interest rate risk?

A. Currency swaps

B. Derivatives like swaps, options, and futures

C. Market segmentation

D. Internal controls

Answer: B. Derivatives like swaps, options, and futures

What is the purpose of hedging in risk management?

A. To eliminate all types of risks

B. To offset potential losses from other investments or exposures

C. To increase market exposure

D. To maximize operational efficiency

Answer: B. To offset potential losses from other investments or exposures

What does ‘stress testing’ involve in risk management?

A. Monitoring liquidity positions

B. Assessing the impact of extreme but plausible risk events on the organization

C. Diversifying assets to reduce risk exposure

D. Managing daily cash flows

Answer: B. Assessing the impact of extreme but plausible risk events on the organization

Which of the following is a global standard for risk management in banks?

A. Basel III

B. IFRS

C. SLR

D. RBI Guidelines

Answer: A. Basel III

What is the main objective of the Basel III regulations?

A. To reduce the number of financial institutions

B. To ensure financial institutions hold adequate capital to absorb shocks

C. To increase profit margins for banks

D. To minimize government intervention in banking

Answer: B. To ensure financial institutions hold adequate capital to absorb shocks

What is ‘Capital Adequacy Ratio’ (CAR)?

A. The ratio of a bank’s total assets to its liabilities

B. The percentage of capital a bank holds against its risk-weighted assets

C. The ratio of customer deposits to the total loan portfolio

D. The percentage of funds invested in government securities

Answer: B. The percentage of capital a bank holds against its risk-weighted assets

In treasury management, what does ‘market risk’ typically include?

A. Fluctuations in asset values due to interest rates, currency exchange, and commodity prices

B. Losses due to operational failures

C. Non-compliance with regulatory requirements

D. Default by counterparties in financial transactions

Answer: A. Fluctuations in asset values due to interest rates, currency exchange, and commodity prices

What is the main purpose of Asset-Liability Management (ALM) in risk management?

A. To ensure compliance with financial reporting standards

B. To optimize the use of funds and minimize financial risks

C. To assess the creditworthiness of customers

D. To evaluate market price fluctuations

Answer: B. To optimize the use of funds and minimize financial risks

What is ‘liquidity risk’ in treasury management?

A. The risk of not being able to convert assets into cash

B. The risk of losing market share in the industry

C. The risk of high levels of debt

D. The risk of adverse market price movements

Answer: A. The risk of not being able to convert assets into cash

Which step in the risk management process involves continuously tracking and updating risk management strategies?

A. Risk Identification

B. Risk Control

C. Risk Monitoring

D. Risk Reporting

Answer: C. Risk Monitoring

What is the purpose of a ‘Risk Register’?

A. To record daily operational transactions

B. To document all identified risks, their likelihood, impact, and mitigation strategies

C. To track employee performance

D. To monitor regulatory compliance

Answer: B. To document all identified risks, their likelihood, impact, and mitigation strategies

What is the primary goal of diversification in risk management?

A. To concentrate risks in a few high-return areas

B. To spread investments across different assets to reduce exposure to a single risk

C. To eliminate all risks

D. To monitor market trends more effectively

Answer: B. To spread investments across different assets to reduce exposure to a single risk

Which of the following is NOT a risk mitigation strategy?

A. Risk avoidance

B. Risk retention

C. Risk elimination

D. Risk transfer

Answer: C. Risk elimination

What is ‘residual risk’ in risk management?

A. The risk that remains after mitigation measures have been applied

B. The total risk from an unmitigated event

C. The risk that can be avoided through insurance

D. The risk from external events only

Answer: A. The risk that remains after mitigation measures have been applied

What is the purpose of ‘stress testing’ in risk management?

A. To simulate extreme market conditions and assess their impact on financial health

B. To evaluate customer satisfaction

C. To measure the efficiency of internal processes

D. To determine potential profits from various risk scenarios

Answer: A. To simulate extreme market conditions and assess their impact on financial health

Which of the following is a key regulatory framework for banks focused on risk management?

A. Basel III

B. IFRS

C. Dodd-Frank Act

D. All of the above

Answer: D

What does the Basel III framework primarily focus on?

A. Improving the efficiency of financial transactions

B. Ensuring banks have sufficient capital to absorb financial shocks

C. Regulating employee compensation in banks

D. Setting interest rate limits for loans

Answer: B. Ensuring banks have sufficient capital to absorb financial shocks

What is the role of ‘Risk Reporting’ in risk management?

A. To monitor the implementation of internal policies

B. To communicate risks to management and stakeholders

C. To track employee performance

D. To assess customer complaints

Answer: B. To communicate risks to management and stakeholders

Which document is used to categorize and manage identified risks?

A. Risk Register

B. Profit and Loss Statement

C. Balance Sheet

D. Cash Flow Statement

Answer: A. Risk Register

Which of the following best describes the primary purpose of Asset-Liability Management (ALM)?

A. To ensure that a bank can meet its short-term liabilities without compromising long-term profitability

B. To monitor customer complaints

C. To maximize asset depreciation

D. To manage insurance claims

Answer: A. To ensure that a bank can meet its short-term liabilities without compromising long-term profitability

In treasury management, what is meant by ‘interest rate risk’?

A. The risk associated with the fluctuation in the value of foreign currencies

B. The risk of changes in interest rates impacting the value of assets or liabilities

C. The risk of default on loans

D. The risk of insufficient liquidity in the market

Answer: B. The risk of changes in interest rates impacting the value of assets or liabilities

What is the purpose of the ‘Risk Matrix’ in risk management?

A. To track the company’s profits and losses

B. To evaluate the probability and impact of identified risks

C. To measure customer satisfaction levels

D. To assess employee performance

Answer: B. To evaluate the probability and impact of identified risks

What does ‘Duration Gap’ refer to in risk management?

A. The difference in the maturity periods of assets and liabilities

B. The time taken to recover from a financial loss

C. The risk of default by borrowers

D. The gap between market trends and financial regulations

Answer: A. The difference in the maturity periods of assets and liabilities